In the same case, if you sell 100 units of the product, then contributing margin on total revenue is $6,000 ($10,000-$4,000). Fixed costs are often considered sunk costs that once spent cannot be recovered. These cost components should not be considered while making decisions about cost analysis or profitability measures.

Variable Costs

If the company realizes a level of activity of more than 3,000 units, a profit will result; if less, a loss will be incurred. You need to fill in the following inputs to calculate the contribution margin using this calculator. Accordingly, the per-unit cost of manufacturing a single packet of bread consisting of 10 pieces each would be as follows. The electricity expenses of using ovens for baking a packet of bread turns out to be $1.

Total Variable Cost

One common misconception pertains to the difference between the CM and the gross margin (GM). A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How does the contribution margin affect profit?

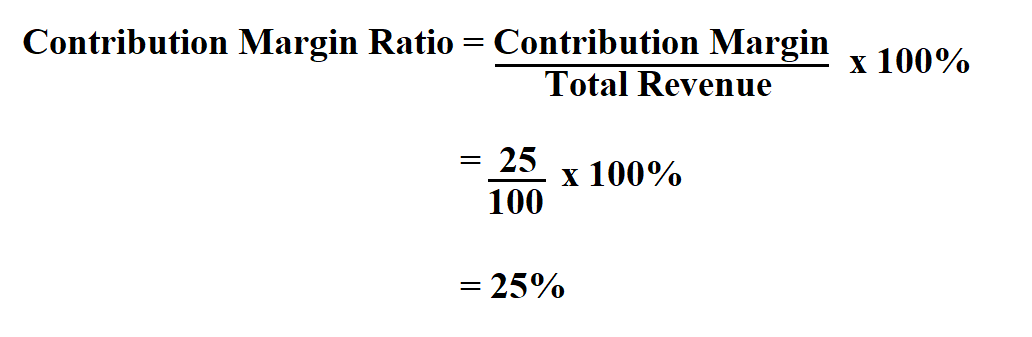

Contribution margin analysis also helps companies measure their operating leverage. Companies that sell products or services that generate higher profits with lower fixed and variable costs have very good operating leverage. Variable costs fluctuate with the level of units produced and include expenses such as raw materials, packaging, and the labor used to produce each unit. The result of this calculation shows the part of sales revenue that is not consumed by variable costs and is available to satisfy fixed costs, also known as the contribution margin. Contribution margin ratio is a calculation of how much revenue your business generates from selling its products or services, once the variable costs involved in producing and delivering them are paid. This can be a valuable tool for understanding how to price your products to ensure your business can pay its fixed costs, such as salaries and office rent, and still generate a profit.

Variable expenses are costs that change in conjunction with some other aspect of your business. Cost of materials purchased is a variable expense because it increases as sales increase or decreases as sales decrease. While a high contribution margin ratio is impressive, it is exit strategies for small businesses important to note that companies should not sacrifice the quality of their product or service purely for the sake of increasing the contribution margin ratio. Striking a balance is essential for keeping investors and customers happy for the long-term success of a business.

- In doing so, they lose sight of a valuable piece of their business.

- Analysts calculate the contribution margin by first finding the variable cost per unit sold and subtracting it from the selling price per unit.

- Suppose you’re tasked with calculating the contribution margin ratio of a company’s product.

- Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Thus, it will help you to evaluate your past performance and forecast your future profitability. Accordingly, you need to fill in the actual units of goods sold for a particular period in the past. However, you need to fill in the forecasted units of goods to be sold in a specific future period.

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Variable costs are not typically reported on general purpose financial statements as a separate category. Thus, you will need to scan the income statement for variable costs and tally the list. Some companies do issue contribution margin income statements that split variable and fixed costs, but this isn’t common. The contribution margin formula is calculated by subtracting total variable costs from net sales revenue.