Conversely, a high ratio could suggest limited growth opportunities and potential difficulty in maintaining dividends if earnings decline. The dividend yield, a key metric for investors evaluating a stock, is the annual dividend amount expressed as a percentage of the stock’s current share price. Not all companies pay dividends and new companies usually prefer to reinvest profits into their growth.

How do your choose dividend stock companies?

On the other hand, a private company may also choose to reward its stakeholders with dividends and share a portion of its profits. In 2010, Mastercard’s (MA 1.33%) dividend yield was a paltry 0.26%, while competitor American Express’s (AXP 0.27%) shares yielded almost 2%. For some investors, Amex’s higher yield represented a “safer” investment since you could always count on that trickle of income each quarter from dividend payments. Yet over the past 13 years, Mastercard has proven to be the far better investment with 1,940% in total returns, more than 4 times the 419% American Express has delivered. Dividends are one component of a stock’s total rate of return; the other is changes in the share price.

Premium Investing Services

Some companies also offer DRIP opportunities (dividend reinvestment plans). In such cases, instead of getting dividends from the company, it automatically gets reinvested into more shares, hence the other name of our tool – the DRIP calculator. A stock dividend, or dividend for short, is a payment made by a company to its shareholders. Dividend payments are usually made from the corporation’s profit, i.e., the company chooses to share parts of its profits with its investors. On the other hand, not all stocks pay dividends – if your main focus is investing for dividends, you will want to specifically seek out dividend stocks.

REITs and dividends

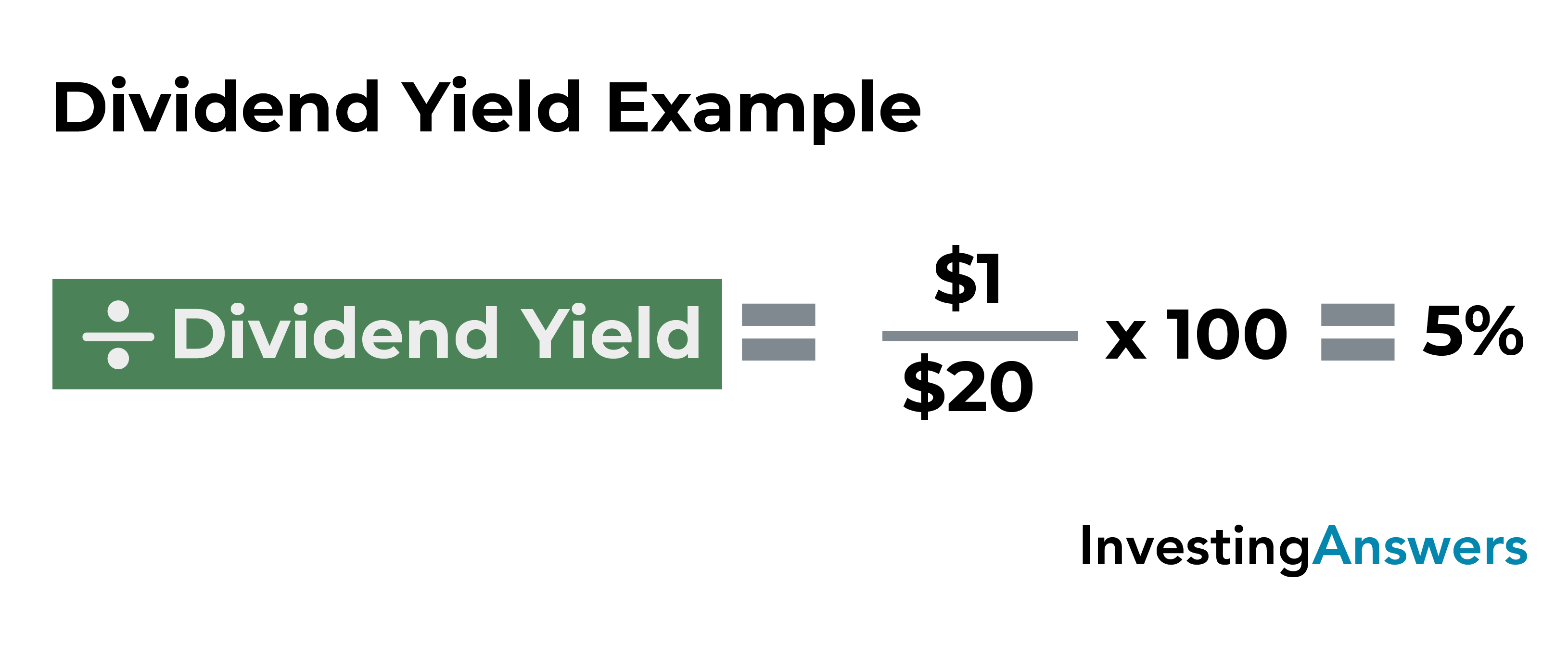

One may also compare such dividend payments about the stock’s share price using a trend of the past 12 months to understand the history of the performance. The dividend yield definition says it’s the ratio of the annual dividends paid by a company over its current stock price. It tells you how much return you are getting as dividends by investing in the stock. Being one of the two main sources of returns for investing in the stock market, it would be unwise for you to neglect the returns from dividends.

Which Stock Has the Highest Dividend Yield?

The forward yield is calculated as Future Dividend Payment / Current Market Price of Share. Preferred issues that are not callable, or whose call date has already arrived, do not have a yield to call or yield to worst. By submitting this form, you consent to receive email from Wall Street Prep and agree to our terms of use and privacy policy. In addition, industry factors must be taken into account, such as the cyclicality in revenue.

- However, a good dividend yield alone doesn’t tell you everything about a stock’s investment potential or even what you can expect in terms of dividends in the future.

- Often, when a company is in trouble, one of the first things it is likely to reduce or eliminate is that dividend.

- The dividend yield is a financial ratio that tells you the percentage of a company’s share price that it pays out in dividends each year.

- Other factors to consider include the company’s debt load, credit rating, and the cash it keeps on hand to manage unexpected shocks.

Companies in certain sectors are known for paying dividends, and dividends are more common among established companies that can afford not to invest all of their profits back into the business. Companies might pay special, one-time dividends, or they may pay dividends at regular intervals, such as every quarter or once a year. When comparing measures of corporate dividends, it’s important to note that the dividend yield tells you what the simple rate of return is in the form of cash dividends to shareholders. However, a good dividend yield alone doesn’t tell you everything about a stock’s investment potential or even what you can expect in terms of dividends in the future. There are some other factors you can consider, along with your own investment goals.

Dividends can be paid monthly, quarterly, semi-annually, or even annually (although quarterly payouts tend to be common in the U.S.). The dividend rate is the annual amount of the company’s dividend per share. • Considering the history of dividend growth and the dividend payout ratio can provide additional insights into a company’s financial health and dividend sustainability.

Most stocks pay quarterly dividends, some pay monthly, and a few pay semiannually or annually. Trailing dividend yield gives the dividend percentage paid over a prior period, typically one year. A trailing twelve month dividend yield, denoted as “TTM”, includes all dividends paid during the past year in order to calculate the dividend yield. While the dividend yield and dividend payout ratio are both important metrics for evaluating a company as a potential investment, they measure different things. Company A has a greater dividend yield due to having a lower stock price. The dividend yield reveals the dividend earnings for each dollar invested.

Assuming all other factors are equivalent, an investor looking to use their portfolio to supplement their income would likely prefer Company A over Company B because it has double the dividend yield. Dividends can help generate some income from your portfolio without selling stock. Depending on your financial situation, dividends may create a tax liability. Mastercard’s enormous growth made it one of the best dividend growth stocks over that period, having grown its payout more than 37-fold. Amex has been no slouch, tripling its dividend, but Mastercard’s dividend growth has been otherworldly.

Historically, market prices of dividend-paying stocks weaken relatively lesser than various stocks having a lower Beta. The benefit of such stocks can stay tall during times of crisis when the stock market falls as they provide stability. They continue to extract dividends even in depressed market conditions, and additionally, such stocks tend to recover quickly from a downfall in the market.

Companies with higher dividends are often larger, more established businesses. But that could also mean that dividend-generous companies are not growing very quickly because they’re not reinvesting their earnings. Since the annual dividends and share price can’t be negative, this means the dividend yield cannot be negative as well. what are the income tax brackets for 2021 vs 2020 With this dividend yield calculator, we aim to help you to calculate the dividend yield of your stock investments. The dividend yield is deemed to be the most important metric to analyze dividends. Hence, before you finalize your investment decision, you need to make sure you understand the meaning of the dividend yield.